Bookkeeping Business Long Island: Comprehending Financial Management for Businesses in Long Island

Efficient monetary management is essential for businesses on Long Island as it motivates informed decision-making and promotes sustainable growth. Organizations can successfully handle intricate financial landscapes and enhance their resource circulation by employing competent financial analysts. This degree of understanding improves profitability and strengthens the ability to withstand financial changes. Ultimately, acquiring a thorough comprehension of monetary management develops the foundation for continuous success and stability in a competitive market.

- Take a look at monetary declarations to examine success, liquidity, and solvency ratios

- Execute budgeting techniques to successfully forecast profits and control expenses

- Assess the return on investment (ROI) to determine the efficiency of company initiatives

- Carry out a cash flow analysis to verify that there suffices working capital for functional requirements

- Conduct variance analysis to compare actual monetary performance versus budgeted projections

Thanks to Bookkeeping Services USA in Long Island, handling the intricate world of financial resources became effortless. The group of astute analysts changed my monetary mayhem into a clear comprehension, enabling me to designate resources effectively. The insights they offered not just increased my profits however also equipped my organization to grow throughout economic difficulties. With their assistance, I've embraced a newly found confidence in my monetary management, setting the phase for sustaining success in a tough market.

Bookkeeping Sevices USA,2191 Maple St, Wantagh, NY 11793, United States,+15168084834

For more information - Click Here

Fundamental Accounting Principles for Community Businesses

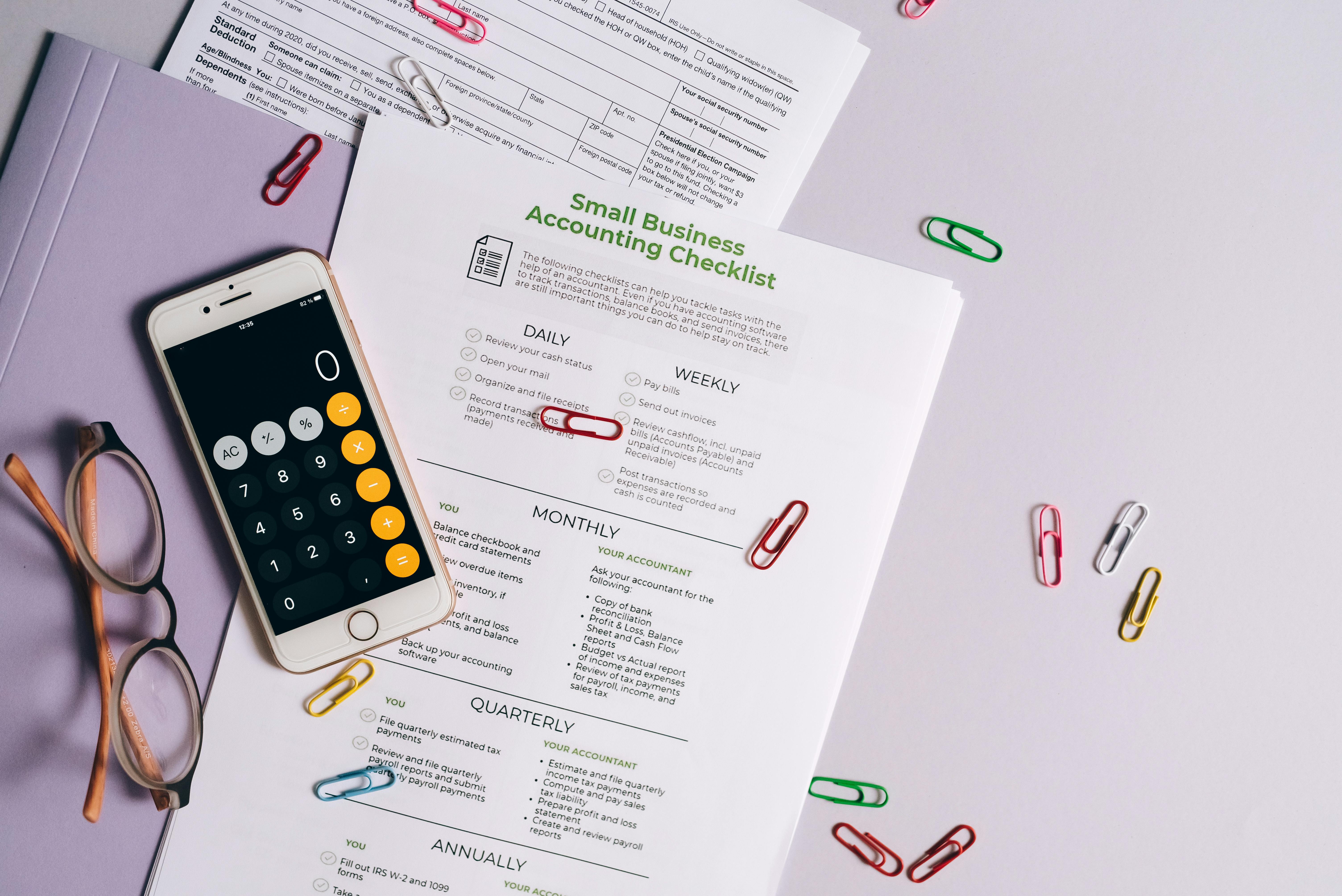

Establishing a strong monetary base is crucial for community-oriented organizations intending to thrive in competitive markets. Establishing cautious record-keeping techniques enables exact tracking of earnings and expenses, supporting notified decision-making. Furthermore, performing routine reconciliations helps to avoid discrepancies and ensures the precision of monetary information. Emphasizing openness in financial reports can cultivate trust among stakeholders, boosting general company credibility.

- Preserve precise and updated financial records to guarantee compliance and help with decision-making

- Create a robust budgeting system to keep track of capital and allocate resources successfully

- Utilize accounting software to enhance processes, decrease mistakes, and enhance reporting functions

- Regularly carry out monetary analysis to uncover trends, assess efficiency, and guide tactical planning

- Establish strong internal controls to protect assets and reduce the possibility of scams in the organization

Bookkeeping Services USA in Long Island, NY has been instrumental in strengthening my financial structure, enabling my community-oriented endeavor to thrive amidst intense competitors. Their extensive documents procedure enables precise tracking of earnings and expenses, enabling me to make informed choices. Routine audits have actually been important in avoiding mistakes and preserving the accuracy of my monetary information. Highlighting openness in financial statements has actually increased their reliability with my partners and substantially bolstered my organization's credibility in the market.

Steering Through Tax Regulations in Long Island

Numerous company owner find it challenging to navigate the intricate tax laws in Long Island. Engaging a proficient monetary strategist can substantially simplify the management of compliance matters and help in keeping compliance with regional laws. Furthermore, using technology to improve monetary record-keeping improves accuracy and promotes transparency in financial matters. Taking a proactive position on tax duties can enhance operational efficiency and decrease potential liabilities.

- Comprehending the specific tax laws and policies relevant to Long Island is important for ensuring compliance

- Get to know the tax regulations at local, state, and federal levels to prevent penalties and fines

- Utilize resources such as the New York State Department of Taxation and Finance for guidance on tax obligations

- Maintain accurate documentation of incomes, expenses, and tax submissions to assist in the compliance procedure

- Consulting a tax expert who concentrates on Long Island tax issues might use important tailored recommendations

Browsing the intricate tax laws in Long Island can be frustrating for many entrepreneur; however, Bookkeeping Services USA has made the process simpler. Their proficient monetary professionals not just structured the compliance procedure but likewise made sure that every regional regulation was carefully complied with. Using innovative read more tools for financial management, they significantly improved accuracy and cultivated a culture of openness in monetary affairs. By taking a proactive position on tax obligations, they ensured that my operations ran efficiently, significantly lessening potential risks.

The Importance of Accurate Record-Keeping for Your Company

Maintaining precise records is vital for any business, as it lays the groundwork for monetary clearness and functional efficiency. A systematic technique for handling records promotes accountability, supports strategic decision-making, and warranties adherence to regulatory requirements. Furthermore, persistent tracking of deals can unveil patterns and insights that drive success and innovation. An arranged data repository allows business leaders to approach uncertainties with guarantee and vision.

- Keeping accurate records improves decision-making by providing dependable data for analysis

- It enhances tax preparation and compliance, decreasing the possibilities of audits and penalties

- Good records help recognize trends and increase operational efficiency through informed insights

- Nevertheless, keeping records can be lengthy and requires continuous effort

- Inadequate record-keeping can result in monetary discrepancies and potential legal issues

The bookkeeping services supplied by Bookkeeping Services USA in Long Island, NY have significantly enhanced my monetary management due to their impressive attention to detail. The thorough paperwork boosts openness, help in strategic planning, and guarantees adherence to legal requirements. Through an extensive assessment of the deals, they acknowledged key trends that improved profitability and encouraged imaginative services. This methodical approach to information management has actually offered me the guarantee to deal with difficulties with clearness and insight.

Picking the Ideal Accounting Solutions to Suit Your Requirements

Choosing the appropriate financial management services needs a nuanced understanding of your distinct fiscal landscape. Evaluate the range of knowledge provided, guaranteeing that the experts have the required certifications and experience to resolve your specific concerns. Evaluate the flexibility of their services, as scalable options can efficiently address your altering requirements over time. Evaluate their technological capabilities, as sophisticated tools can significantly boost the accuracy and effectiveness of your financial reporting.

- Accounting Services USA offers tailored options that deal with the special requirements of each client, guaranteeing the best fit for varied company demands

- A group of qualified specialists offers tailored guidance and insights, helping customers in making informed choices concerning their accounting services

- The organization employs cutting-edge technology and software to enhance effectiveness and accuracy in monetary reporting

- They focus on transparent interaction, keeping customers notified about their financial status and any modifications in regulations

- Accounting Services USA highlights ongoing support and education, empowering clients to better understand their financial health and accounting practices

With the assistance of Bookkeeping Services USA in Long Island, NY, handling monetary affairs has actually ended up being a smooth experience. Their large knowledge and qualifications ensured that my particular financial problems were managed with precision and proficiency. I was specifically impressed by their flexible service offerings, which perfectly matched my developing needs as my service broadened. Moreover, their advanced innovation changed my monetary reporting, significantly enhancing precision and efficiency beyond my expectations.

Typical Accounting Mistakes to Avoid in Long Island

Disregarding to keep accurate records can lead to significant financial disparities, which might lead to unforeseen problems during tax time. Abnormalities in account reconciliation can result in a deceptive sense of security, concealing much deeper problems. In addition, stopping working to categorize expenditures can obscure the understanding of cash flow, making complex the evaluation of success. Ultimately, relying entirely on out-of-date software or manual techniques can impede efficiency, making complex the ability of companies to adjust to evolving monetary conditions.

Accounting Services USA in Long Island, NY, changed my financial situation by diligently managing my records, making sure that no errors would emerge during tax season. Their proactive technique of account reconciliation uncovered underlying issues, clarifying the actual condition of my financial resources instead of letting an impression of stability continue. Their aid in arranging expenditures provided me essential insights into my capital, enabling a more precise examination of my company's success. Additionally, their understanding in updating my financial treatments eliminated the inadequacies associated with out-of-date practices, enabling me to confidently browse the continuously developing economic landscape.